The discussion upon Gaussian vs. other forms of stable statistical distributions wast not born in a recent best-selling book.

The discussion upon Gaussian vs. other forms of stable statistical distributions wast not born in a recent best-selling book.

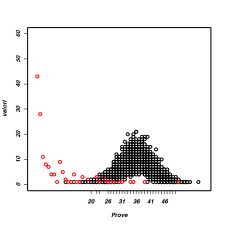

It was brought up by Vilfredo Pareto a century ago and then again, in specific relation to finance, by Benoît Mandelbrot in the 1960’s, when he suggested that markets do not follow a normal Gaussian but rather a leptokurtic, heavy-tailed Pareto distribution.

This is what happens when the constraint of finite variance on the participating stochastic variables (e.g.; securities prices, individual risks, et cetera) is relaxed: from the Central Limit theorem, we derive no longer a Gaussian but rather other stable distributions (although not necessarily a “power law“, as is believed in popular versions of the theory).

If Mandelbrot is right, the current forecasting models (e.g. those for risk assessment, which failed in 2008) are wrong and it would be little surprise that they be not very good at anticipating even highly-impactful events.

Leave a comment